The financial industry is getting more exciting than ever with all of the technological advances in the field. Fintech seamlessly integrates financial services with technology to deliver an unprecedented user experience, making digital services more accessible, convenient, and efficient for consumers and businesses.

As a relatively new field, there is always room for new players entering. If you have an interesting idea for a new fintech application, but don’t know where to start, this guide is for you. In this article, we’ll cover in-depth the specific steps you need to take to materialize your idea into a fintech product. Read on to learn how to build a fintech app in 2024.

Table of Contents

Step 1: Define Your Niche & Business Model

Start from the generals and then work your way down to the specifics. Write down your idea and carefully analyze it to determine the niche it belongs to. Is it built to improve payment security and convenience? Is it a robo-advisor for investors/average users/businesses? Is it insurance-related?

If you want a good starting point, here are the top niches in the 2024 fintech market:

- P2P Lending

- Robo-advisors

- Digital wallets

- Cryptocurrency & Blockchain

- Insurtech

- Regtech

- Personal Finance

- Crowdfunding

- Real Estate Fintech

- Small Business Fintech

From this, further deep-dive into the unique characteristics of your product. Understand the demographic you target and the competitive advantage you have. Although you don’t need to have a ground-breaking innovation to have that “advantage”, make sure to have a unique marketing angle or business model. This step prepares you for the next phase, which is market research.

Step 2: Perform Market Research

Once you have narrowed down your niche, it is time to explore the competitors in that niche. Browse around the Internet to find companies offering similar services/products to yours, check out their features, look at their reviews from reputable review sites such as G2 to see what users like and dislike about these competitors. Product Hunt is another good place to find similar products.

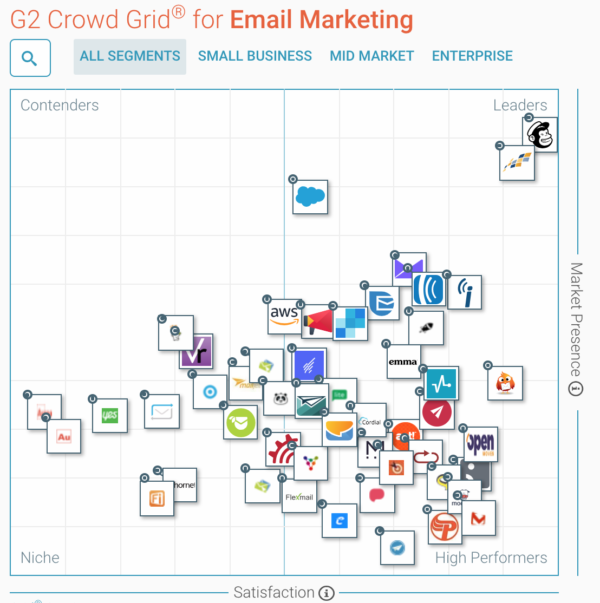

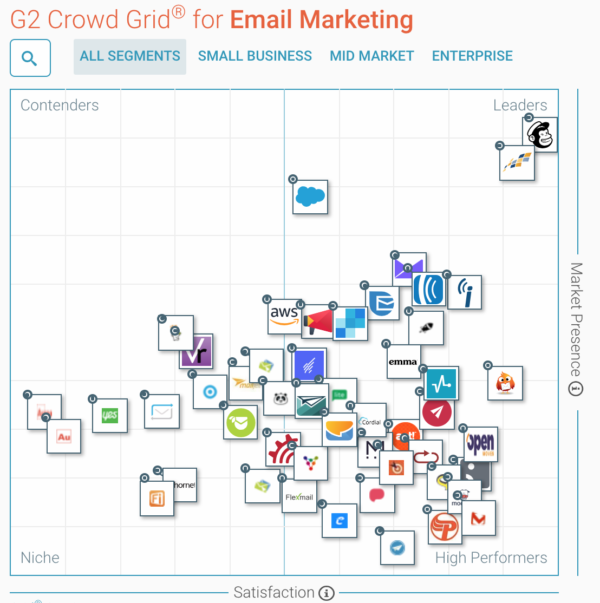

An interesting feature that G2 has is a Crowd Grid, which essentially categorizes competitors in the same niche into 4 different quadrants, representing 4 spectrums of competitiveness. You can use this to have a comprehensive understanding of the arena you are about to step into.

If you are ready to invest, you can even do some keyword research with Ahrefs or SEMRush then launch a PPC campaign for your product to gauge the level of interest. If there is some interest, it is time for development. People who demonstrate initial interest in your product can later be leveraged for test launch.

Step 3: Define MVP Scope

You can now define MVP scope by selecting the “must-have”, “should-have”, and “nice-to-have” features. At this stage of your fintech app, it is better to just focus on the “must-have” and “should-have” first, and leave the nice-to-have for future development.

A great way to do this is setting up a table where you grade the features you want to be included in your fintech app on a scale of 1 – 100 (of course, this is only exemplary, you can create a system that fits your specific requirements). Pair each feature with a specific user need so you can better consider if your solution can actually solve the problem.

For grading criteria, here are several suggested questions to ask:

- Is this an important user need?

- Is this a popular user need?

- How much value does this feature bring to the users?

- Is our feature unique/better than features of existing competitors?

- What is the resource availability to develop this feature?

Add up the points, and you should have a quantified view of your product with areas to target for MVP

| Points | Feature Description | User Needs | MVP? |

| 60 | Feature 1 | To be considered | |

| 70 | Feature 2 | Yes | |

| 40 | Feature 3 | No | |

| 80 | Feature 4 | Yes |

Step 4: Form a Team & Prepare Resources

From the list of features to develop, you can assemble your team with adequate technical expertise to kick-start the project. Generally you would want to have at least 1 technical person turning the idea into a product and then 1 sales/marketing person to bring the product to its potential customers.

The process of hiring a technical person can be challenging, especially if you are more into the business side, so here’s a guide on how to hire the right developer for your project. These developers can create the product for you, but, more importantly, they can also act as a consultant to help you determine what techstack to use. Fintech is a particularly sensitive field with a wide range of regulations to follow, so choosing the right technology from the very beginning means a lot for your business and users.

Generally there are 5 areas to consider when it comes to choosing the right techstack for your fintech application:

- Frontend technology

- Backend technology

- Security

- Data analytics & AI

- Cloud computing

Step 5: Design

After that comes the design stage. This is when you need an artist to come in and create a perfect balance between aesthetics and usability. Make sure to establish some consistency between your in-product design, your web design (if you decide to have one), and your marketing design. In other words, product design and branding should go hand-in-hand. You can totally incorporate more branding attributes in your product later down the line, but defining your brand image in advance truly benefits your future marketing efforts.

For in-product design, try to understand the Fintech UX best practices. For this particle field, users prefer stability, trustworthiness, reliability, security, and compliance, so incorporate those concepts into your app.

For example, you can go with simple, easy-to-navigate, and intuitive menus rather than a flashy approach. Language used should be exact, concise, and transparent. The colors you use should be soothing and calm, activating that sense of safety from traditional financial services in the user’s mind.

Step 6: Development

Agile development is a widely popular methodology in the tech startup community, and there is a reason why. Develop your fintech app with Agile principles in mind, which promotes iteration and flexibility. Usually, these time-boxed sprints span a month or less, with another one beginning immediately after the last.

Step 7: API & Integrations

APIs carry the digital world with its capabilities to transfer data across applications, and in the fintech world, APIs allow financial vendors/portals to connect and perform their services more efficiently.

Several important API tools/technologies to consider include:

- Swagger: an API documentation tool that enables developers to design, build, and document APIs using the OpenAPI Specification

- Katalon Platform to create API tests, manage, schedule, then execute them, then receive detailed reports for those API tests

- AWS API Gateway to create, publish, maintain, monitor, and secure APIs at any scale

Step 8: Testing

Testing is an incredibly important part of developing applications. More than just “checking for bugs”, testing can also provide detailed insights into the development process and allow you to maintain and enhance the effort. For fintech applications in particular, functional testing and security testing are 2 of the most important areas.

Make sure to achieve a balance between manual testing and automation testing. Perform manual testing for scenarios requiring human interaction (such as app usability), but for scenarios that are highly repeatable (such as testing the functionality of a certain button), go for automated testing. Here are some of the top automated testing tools on the market currently.

At the same time, balance your testing with development efforts by following the shift-left approach. Simply put, testing used to happen after development, but more and more QA teams are shifting their testing activities to happen along with development (hence the name shift-left).

Instead of testing only when the entire application has been fully developed, teams can test gradually along with the dev team, which saves a lot of time and provides constant feedback.

Step 9: Launch & Marketing

Once all tests are completed, it is time for launching. Here we are moving to the domain of marketing. There is no real playbook to your product marketing, since it all depends on the uniqueness of your innovation.

However, there are only so many channels to explore.

As mentioned, you can run a PPC campaign to gauge the initial interest, then once you’re done with the product, launch another PPC campaign to generate brand awareness and capture the initial leads. For more long-term strategies, consider investing into SEO by writing thought-leadership/tutorial articles on your product. Social media, email, and even podcasts are other great channels to consider.

Step 10: Continuous Monitoring & Update

This is when you know if your product has potential to go to the next level or not. Have a system to capture in-app usage data or web data and analyze those data to reveal critical insights about your product. From those insights, you can start to understand how users are interacting with your app, areas to optimize, and opportunities to explore.

This is also the stage where you can start implementing nice-to-have features, and once you have gathered a large enough user base, you can even launch a survey aimed at a specific set of users who demonstrate high interest in your product to get their feedback.

Wrapping Up

Building a fintech app in 2024 is truly a journey that demands careful planning, continuous adaptation, and commitment. With the steps outlined above, you should be more well-prepared to navigate the ever-evolving landscape of fintech and make a meaningful contribution to this exciting industry.