Fintech services are all about numbers, charts, and tables. And there is no denying that many users can find it boring!

Yes, except on the days when crypto breaks the market and becomes a global phenomenon, most users barely open their fintech apps.

However, this scenario can be changed, just by adding a little fun element to your financial products. Wondering how? The short answer is by introducing gamification in fintech.

Adding game-like elements to your fintech apps can help businesses engage users more effectively and turn tedious financial tasks into fun and rewarding activities. As per a report by Finances Online, adding gamification elements has helped companies boost their conversion rates by a staggering 700%. Sounds incredible, isn’t it?

Today, we will delve into the concept of gamification in fintech and help you discover practical ways to add gamified elements to your financial products.

Table of Contents

Understanding Fintech Gamification

Traditional financial activities such as paying bills or monitoring expenses are often perceived as unexciting or even daunting tasks. And considering how most people rely on technology nowadays to perform these tasks, for a technically challenged individual, this becomes even harder.

Fintech gamification involves incorporating gaming elements into the fintech app to make using these apps simpler, more approachable, and even fun. These simple elements demonstrate to users that taking care of finances can be easy and comprehensible. This boosts user interaction and makes the user experience more enjoyable.

Imagine a scenario where saving money becomes a challenge that users must overcome or budgeting is a game of strategy. Several fintech gaming elements like progress bars, leaderboards, points, levels, etc. can be strategically integrated into fintech apps to enhance financial literacy and reduce the pressure often associated with financial tasks.

Examples of Gamification in Fintech

To help you better understand the above concept, we have put together some fintech gamification examples. These will help you discover ways to include various game elements in your fintech app.

Goals and Challenges

Fintech gamification goals and challenges are similar to video game quests. Users establish financial objectives and overcome challenges to meet those objectives and improve their financial well-being.

For instance, fintech apps can allow users to create saving goals and offer rewards for their accomplishments. Additionally, the apps can place budget limits that help people reduce the problem of extra expenditures.

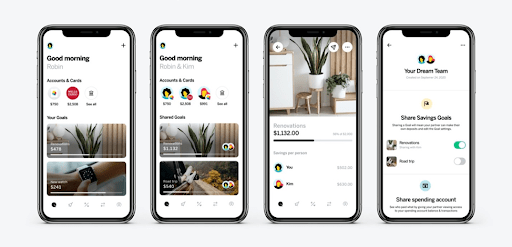

Currently, several fintech apps are utilizing this gamification element to boost user engagement. For instance, the Qapital banking app allows its users to establish saving, spending, and investing targets. It also offers intuitive visualization of the “Goals and Rules” functionality to keep the users engaged.

Image: Source

Image: Source

Gamified Educational Content

An effective yet highly underutilized approach to fintech gamification is incorporating educational games. This helps to increase awareness around financial concepts while boosting overall user engagement.

Fintech companies can incorporate quizzes, puzzles, videos, etc. within their apps to make the financial learning process more engaging and accessible. They can also have a point system enabling users to win attractive rewards, such as tickets to social events, by attempting these quizzes.

Google Pay in India is brilliantly utilizing gamified educational content to enable users to learn about topics such as CIBIL credit score and ways to improve and manage their credit scores better.

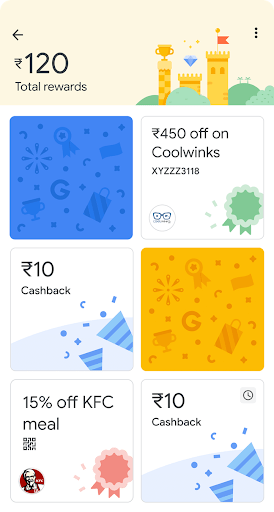

Rewards, Points and Cashbacks

Offering striking rewards or cashback is a great way to attract and retain customers. These incentives serve as catalysts to promote continued engagement. Typically, financial institutions collaborate with other banks and retailers to create such incentives.

For instance, a fintech app can allow its users to earn exclusive coins for purchasing products from their partner retailers and later redeem these coins for gift vouchers, coupon codes or discounts.

One more time, Google Pay demonstrates an excellent example of this through its rewards system. The company offers its users enticing rewards, ranging from coupons to cashback, on every transaction.

Image: Source

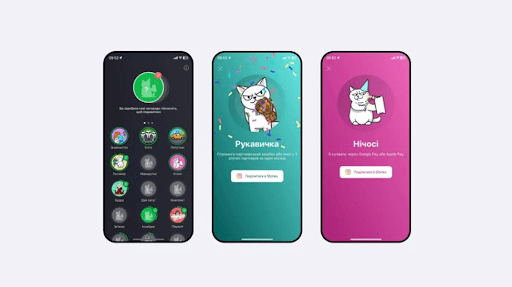

Achievement Badges and Collectibles

Another one of the effective ways to leverage gamification in fintech is utilizing an achievement-based system. This involves giving away badges to users for meeting milestones or completing specific financial tasks, such as using credit cards abroad, spending money of certain categories, or splitting a bill with friends. Unlocking achievement badges can keep users entertained and boost retention rates.

Monobank, the famous Ukrainian banking app, has launched an achievement program for users. It allows users to complete simple financial tasks, such as using ApplePay for a transaction and earning up to 103 badges. More badges mean more exciting prizes. This keeps the users motivated to complete routine banking in return for rewards.

Image: Source

Best Practices for Implementing Gamification in Fintech

Fintech companies must understand that gamification is not a game with money. The goal of introducing gamification in fintech apps is to turn dull financial activities into entertaining tasks while maintaining the balance between fun and intentness.

Here are a few best practices that you must consider when mapping out your fintech gamification strategies.

Pay attention to personalization

Fintech apps offer a wealth of precious customer data. You can effectively utilize this data to offer personalized financial goals, strategies, challenges, etc. that are tailored to each individual’s journey. Similarly, you can offer valuable content such as educational videos or even online courses to boost engagement.

Include avatars

Most popular games nowadays allow their users to create their own customized avatars. It is an incredible social element, and leveraging it in fintech apps can turn mundane financial processes into much more fun.

Prevent ‘tilting’ behavior

Tilting is a term used in gaming that describes overly aggressive behavior that results in negative outcomes. It is the decline of one’s gaming ability as an emotional reaction to in-game events, such as a player betting all their money on a bad hand of a card game.

Whatever fintech solution you develop, it must be designed to prevent tilting so that the users don’t make any regretful mistakes with their money. Instead, the apps must be designed in a way that encourages positive financial behavior, such as savings.

Moneybox does a great job of inspiring its users to invest. It allows users to round up their everyday purchases and invest the spare change, making the concept of investing all the more engaging.

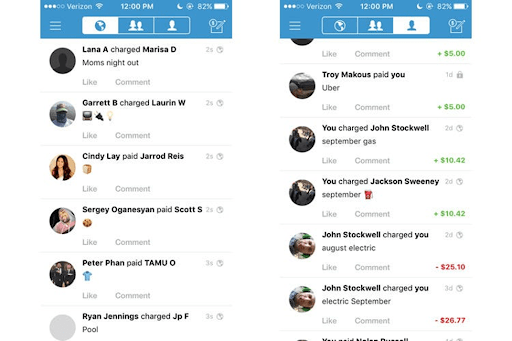

Promote group play

Gamification elements that encourage group play foster a better customer experience. When two or more people communicate, team up, or even compete against each other, it creates a sense of community. This, in turn, boosts customer retention.

Venmo, for instance, offers a Groups feature that makes it easy for friends and family to track shared holiday expenses and split bills amongst each other.

Integrate social features

To boost customer engagement and diminish churn rates, fintech companies can integrate social features and community-building elements into their apps. Such gamification elements can help to boost collaboration and peer support while ensuring a satisfying user experience.

Once again, Venmo demonstrates a brilliant example of this with its social feed functionality. The platform offers a social feed that displays transactions between users who are connected to the platform.

Users can see who their friends are paying and what they’re paying for. This feed often includes playful or humorous descriptions accompanying transactions, adding a social aspect to the app.

Image: Source

Future Trends in Gamification and Fintech

Fintech industry gamification has been steadily gaining traction. As per a report by MarketsandMarkets, the gamification industry which stood at $9.1 billion in 2020 is projected to reach $30.7 billion by 2025, growing at a CAGR of 27.4% during the forecast period.

Now we will look at the leading fintech gamification trends that are likely to emerge in the coming years.

Prioritizing users’ financial well-being

Fintech apps will focus on ethical development, prioritizing each user’s financial well-being and promoting responsible financial habits. By incorporating gamified elements such as rewards, challenges, and progress tracking, these apps can easily push users towards actions that align with their long-term financial goals such as investing wisely, saving more money, or reducing expenditure.

Integration with AI

Cutting-edge technologies such as AI are driving massive innovation in the fintech industry. Talking about AI, the technology is reshaping key areas of fintech including fraud prevention, customer experience, and data-driven investing. AI voice generators are revolutionizing fintech apps by enabling secure and hands-free access to financial services through natural language interactions.

In the coming years, more financial companies will leverage AI in fintech gaming. This can include leveraging AI-powered analytics to deliver hyper-personalized financial services.

Emergence of robo-advisors

Another one of the leading fintech gamification trends is the integration of robo-advisors into investment platforms. Robo-advisors, powered by AI algorithms, offer personalized financial advice that is tailored to each individual’s financial goals and investment preferences. They can analyze vast amounts of data to offer personalized investment recommendations, creating a more interactive experience for users.

Experts predict that robo-advisors will be gamified in the coming times to enhance user engagement and promote better financial decision-making.

Cryptocurrency and blockchain gamification

Statistics reveal that the global blockchain market will grow 143 times before the end of 2030, reaching $1.5 trillion in volume.

With the rising popularity of blockchain and cryptocurrencies, the intersection of fintech and gaming is likely to expand. We can expect to see the emergence of blockchain-based games that use financial elements like NFTs, digital assets, and DeFi mechanics.

Conclusion

The future of fintech and gamification looks massively intertwined. Gamification in fintech can be used to educate customers about complicated financial concepts, motivate them to improve their financial well-being and reward them for good financial behavior.

While the rise of gamification in the finance industry is creating several new opportunities for growth and innovation, it is also posing certain risks and challenges. Many critics argue that gamification can inspire aggressive behavior, such as excessive trading. There is also a risk that interactive, gamified elements can oversimplify complex financial concepts, creating a false sense of security.

Therefore, financial companies and consumers must work together and ensure that gamification is used ethically and responsibly.