How blockchain is revolutionizing the banking industry

With an initial purpose of a mechanism behind cryptocurrencies, today the blockchain technology has stepped far beyond just powering the bitcoin or ether transactions. Blockchain is a powerful and secure technology that is getting into almost every industry, from banking and medicine to the government sector. According to Forbes, blockchain brings the following benefits:

- Blockchain records and validates each and every transaction.

- Blockchain does not require third-party authorization.

- Blockchain is decentralized.

The most popular domain of blockchain use is the banking sector because security is of utmost importance for the financial domain. So in this article, we are going to talk about how blockchain can revolutionize banking.

We will share with you several use cases of blockchain technology finance, highlight the pros and cons of each of them, and illustrate them by some real-life examples.

#1. Payments, Especially Cross-Border Payments

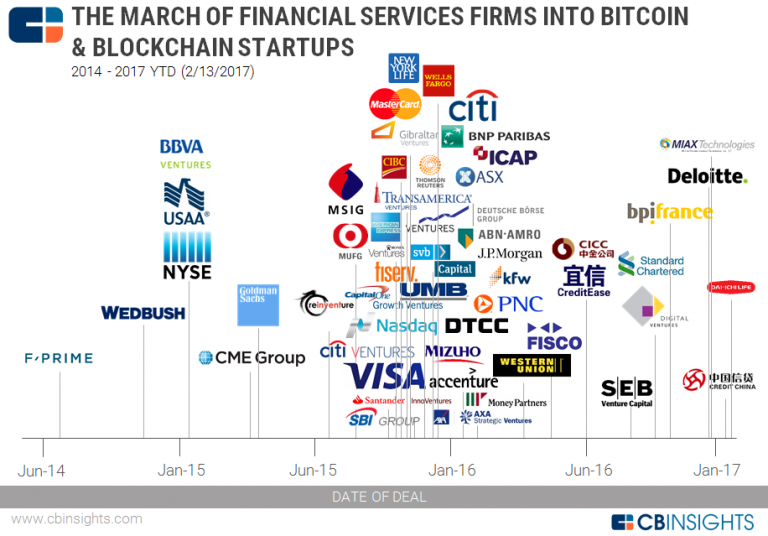

Payments are the first and foremost use case of any banking and/or financial system. When it comes to blockchain finance, both central and commercial banks all over the world are now tapping into this new technology in terms of payment processing and potential issuing of their own digital currencies. This trend also embraces the cross-border payments, which have been powered mostly by Swift or Western Union until now.

- Pros: Cross-border payments are faster and less expensive with bank blockchain than with traditional systems. For example, remittance costs within the blockchain are 2-3% of the total amount, as compared with 5-20% withheld by other third parties. Besides, as we have already mentioned, blockchain does not require a third-party authorization, thus significantly speeding up the cross-border payment process.

- Cons: If the cross-border payment is made in cryptocurrencies, it can impose certain security-related risks. For example, if you transfer cryptocurrency funds from one country to another by applying blockchain technology financial services or wallets and one of the service providers goes bankrupt or suffers a hacker attack, the funds will be lost and no central authority such as a bank can reimburse such loss. Besides, there can be problems with cryptocurrency exchange into local currency at the destination because of fluctuating exchange rates.

- Usage Examples: In 2016, Westpac, one of Australia’s largest banks, partnered with Ripple, an enterprise blockchain solution for global payments, to implement a low-cost cross-border payment system based on blockchain technology. In 2015, CBA, another large Australian bank, was planning to partner with Ripple in order to develop a ledger system on blockchain for payments settlements between its subsidiaries. In 2016, the US Federal Reserve was working with IBM to implement a blockchain-based digital payment system. And these are not the only examples of banks using blockchain – other well-known banks tapping into the blockchain are Deutsche Bank, Barclays Bank, BNP Paribas, etc.

#2. Stock Exchange and Share Trading

Buying and selling stocks and shares has always involved a lot of third parties, such as brokers and the stock exchange itself. Here is how trading works:

- The buyer or seller initiates the trade.

- A broker sends a transaction to a stock exchange.

- The transaction is matched with another party (the counterparty).

- The transaction is sent to Central Counterparty Clearing House for risks evaluation.

- The buyer’s or seller’s representatives work with the Central Securities Depository (CSD) to record the transfer.

- The transaction is sent to the Registrar or Transfer Agent of Initial Trade to update their list of shareholders.

As you see, the traditional stock exchange process involves lots of stages and bureaucracy and can take up to 3 days. However, the decentralized nature of blockchain technology in banking can remove all those unnecessary intermediaries and enable trading to be run on computers all over the world. No more dedicated servers united into an interconnected network.

- Pros: Trading transactions in blockchain reduce the redundancy of information and thus improve performance. As a result, smaller transactions between groups of traders can be quickly handled outside the blockchain, and only the final transactions are recorded to the blockchain, without any intermediary steps.

- Cons: Trading with blockchain can impose risks such as “private keys” – variables that are used for a number of the electronic signature options available, that can be potentially stolen or lost. Those keys prove the ownership of specific assets, thus allowing the hackers to change the ownership. However, there is a way out – multi-signature transactions that can be integrated into the asset trading applications running on blockchain technology. Signatures of all parties before agreeing upon a transaction can prevent the keys from being stolen and the ownership from being changed.

- Usage Examples: In 2015, Nasdaq, the world’s second-largest stock exchange company, was planning to use blockchain for their Private Market Platform. They were going to implement a colored coin concept that could help to distinguish the coins used for trading from other coins. Besides, together with Citigroup, Nasdaq invested into the Chain blockchain ledger to power a shared and trusted distributed database that records all transactions and ownership changes in real-time.

#3. Trade Finance

Blockchain also plays an important role in the trade finance sector – financial activities that are related to commerce and international trade (not stock exchange trading). Even in today’s disruptive world of technology, many trade finance activities still involve lots of paperwork, such as bills of lading, invoices, letters of credit, etc. Of course, many order management systems allow to carry out all this paperwork online, but still, it consumes lots of time. As technology continues to advance and streamline processes in the trade finance sector, investment opportunities in companies utilizing blockchain and other innovative solutions may arise. Using SoFi Invest, you can explore a range of investment options tailored to suit your financial goals and risk tolerance, allowing you to diversify your portfolio and potentially benefit from the growth of businesses leveraging blockchain technology in trade finance.

- Pros: Blockchain-based trade finance can streamline the entire trading process by getting rid of time-consuming paperwork and bureaucracy. For example, within a traditional trade finance system, all participants must maintain their own database for all transaction-related documents. Each of these databases must be constantly reconciled against each other, and a single error in one document can be duplicated to copies of the document. Blockchain eliminates such need for several copies of the same document and can integrate all necessary information in one digital document, which is updated in real-time and can be accessed by all network members.

- Cons: Government sanctions, such as trade embargoes, can impact the use of blockchain technologies in trade finance. For example, the blockchain-based software could not be sold to or licensed for use by sanctions targets without an OFAC or BIS license. Besides, it is impossible to transfer the trade transaction information in blockchain format to parties who do not use the platform.

- Usage Examples: In 2016, Ornua, an Irish manufacturer of dairy products, partnered with Barclays to complete the world’s first blockchain and banking trade transaction. In 2017, IBM and Maersk collaborated to work on the first cross-border, blockchain-based supply chain solution.

#4. Digital Identity Verification

Online financial transactions are impossible without identity verification. However, this verification requires a lot of steps to be taken, such as:

- Face-to-face checking (can be also via a video call such as Skype).

- Authentication: The bank client needs to prove their identity every time they log in to the service.

- Authorization: A proof of the client’s intentions is needed.

All of these steps need to be taken for each new service provider. However, blockchain makes it possible to securely re-use identity verification for other services.

- Pros: With blockchain in fintech, users can choose how they identify themselves and with whom they agree to share their identity. They still need to register their identity on the blockchain, but they do not need to repeat the registration for each service provider if those providers are also powered by blockchain.

- Cons: Standards for identity verification on the blockchain are still being developed. After the information is recorded on the blockchain, all parties in the network can access it, so the users should limit any private information that they do not want to disclose.

- Usage Examples: Cambridge Blockchain and Tradle are examples of fintech startups that are using blockchain to disrupt banking and working on blockchain-based customer identification systems.

Tradle uses blockchain to store proofs of data verifications and give total ownership and control of data to the owner. This means the customer manages the sharing with banks directly, thus the customer becomes the utility. Tradle’s approach enables the owner to share their data across lines of business, with any institution and across any border without breaching any data locality laws, or regulations such as GDPR.

Another example is ID2020, a project aimed at creating digital identities for people who have no paper IDs. The project is supported by Accenture, Microsoft, and the Rockefeller Foundation.

#5. Syndicated Lending

Syndicated lending refers to providing loans to individuals by a group of lenders, typically banks (a syndicate). Due to several participants involved, the traditional processing of such syndicated loans by banks can take up to 19 days. Banks that process syndicated loans face the following challenges:

- Know Your Customer (KYC) – client identity verification.

- Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) – legal actions aimed at prevention, detecting, and reporting of money laundering activities.

Blockchain financial services can supercharge this process and make it more transparent. With blockchain’s decentralized ledger, banks within a syndicate can distribute tasks related to local compliance, KYC or BSA/AML and link them to a single customer block.

- Pros: The use of financial blockchain for syndicated loan processing can bring the syndicate members a range of benefits in terms of compliance. If one of the banks using blockchain in a syndicate has completed the compliance procedures, all other banks do not have to do it once again. As a result, each participating bank can benefit from blockchain technology in banking by exchanging information through blockchain. This lowers the cost of meeting regulatory requirements for syndicated lending and significantly saves time.

- Cons: Blockchain is unable to solve all problems on a syndicated lending market. In addition, it may be hard to implement blockchain for syndicated loans, because it should be done for each bank in a syndicate. However, nowadays banks tend to join into blockchain syndicates to make this process easier.

- Usage Examples: In 2016, Credit Suisse, Symbiont, R3, and Ipreo successfully finished an initial stage of a project related to the use of blockchain technology on the syndicated loan market. In April 2018, seven international banks, specifically BNP Paribas, BNY Mellon, HSBC, ING, Natixis, and State Street, have united to support Fusion LenderComm by Finastra, a blockchain platform for syndicated loans.

Hire developers for your blockchain project

#6. Accounting, Bookkeeping, and Audit

Probably no other sphere that involves as much paperwork as accounting, and it is digitalized relatively slowly. The reason behind that may be in strict regulatory requirements regarding data validity and integrity. Therefore, accounting is another domain that can be transformed with the power of blockchain technology finance, from simplifying the compliance to streamlining the traditional double-entry bookkeeping. Instead of keeping separate records based on transaction receipts, companies can write their transactions directly into a joint register, with the entries distributed and cryptographically protected. As a result, the records are more transparent, and any attempts of forging are almost impossible. Think of it as an “electronic notary” verifying the transactions. In addition, blockchain’s smart contracts can be used to automatically pay invoices.

- Pros: Standardization with the help of blockchain would allow auditors to automatically verify the most important data behind financial statements and thus decrease the costs and save time. Blockchain makes it possible to easily prove the integrity of electronic files. One of the approaches is to build a hash string of a file representing the digital fingerprint of that file and then create a timestamp for it by writing it into the blockchain. To prove the integrity of files, an auditor can generate the fingerprint again and compare it with the one that is stored in the blockchain. Identical fingerprints prove that the file has not been changed. As a result, audits can be conducted in real-time and not last for days or weeks.

- Cons: Some experts suppose that blockchain may not be suitable for each and every case in bookkeeping and may be used only for specific areas, such as interbank transfers.

- Usage Examples: In 2018 PricewaterhouseCoopers announced the launch of the first blockchain auditing service that will allow checking how the companies are using fintech blockchain.

#7. Credit Reports for Businesses and Individuals

Blockchain finance can also help individuals and small businesses to quickly get loans based on their credit history. It may take a long time for lenders to review the borrower’s credit history. Traditional business credit reports provided by third-party credit bureaus are not available for small business owners. Besides, paying companies to access their sensitive data sounds strange and insecure. However, blockchain can provide tools that will allow borrowers to make their credit reports more accurate, transparent, and securely shareable. Here’s how it works with blockchain:

- The data owner places their transaction history into the blockchain and secures it with a private key.

- The encrypted transaction is stored outside the blockchain.

- The hashed encrypted transaction is stored inside the blockchain with timestamps and metadata.

- The data buyer submits the criteria for credit history.

- The smart contracts identify and verify the potential data based on the data owner control criteria.

- The blockchain engine filters the data and returns the results.

- Pros: Blockchain-based credit reports reduce the costs and complexities pertaining to data verification. Besides, the data ownership is returned to individuals because it is no longer held in a central repository.

- Cons: According to New York Times, some experts express a concern that blockchain’s immutability, i.e. inability to revert changes, can fail to comply with the new data privacy regulations and violate human rights to become forgotten. Besides, US regulations such as the United States Fair Credit Reporting Act, the Gramm-Leach-Bliley Act, and the Securities and Exchange Commission’s Regulation S-P prohibit such immutability of personal financial data.

- Usage Examples: Credit Dream is a Brazilian mobile blockchain platform that connects lenders and borrowers in any country for affordable and verified loans.

#8. Hedge Funds

A hedge fund is an investment partnership consisting of a fund manager and a group of investors (limited partners). However, hedge fund participants are traders rather than ordinary investors. The purpose of a hedge fund is to maximize investor returns and minimize risks. According to Autonomous NEXT, the number of hedge funds that trade cryptocurrencies has doubled between October 2017 and February 2018. However, one should distinguish between the traditional crypto hedge funds and decentralized crypto hedge funds.

- Pros: Decentralized crypto hedge funds provide an open platform allowing many more crypto investors and strategists to participate, whereas traditional crypto hedge funds are controlled by fund managers within a single entity, Forbes reports.

- Cons: Individual investors are afraid of the risks resulting from borrowing crypto coins by short-sellers.

- Usage Examples: Examples of decentralized crypto hedge funds are Alphabit Fund, Blocktower Capital, CoinShares, Crypto Asset Fund, and many others.

#9. Crowdfunding (ICOs)

Crowdfunding involves raising funds by asking a large number of people each for a small amount of money, typically online. This industry is a perfect fit for blockchain technology finance. Initial Coin Offerings (ICOs), financial instruments that help to kickstart young cryptocurrencies, are the most known example of blockchain-based crowdfunding. ICO tokens are similar to shares of a company, though usually without equity exchange. Instead, the investors purchase tokens either for existing cryptocurrency, such as bitcoins, or for physical currency, such as US dollars. Later, in case of success, they can sell these tokens on cryptocurrency markets. Like in crowdfunding, funds are raised to implement a concept at the stage when the company has no product.

- Pros: ICOs have a range of advantages, such as the ability to sell the tokens internationally over the Internet, liquidity premium of the tokens, and decentralization of funding with the ability to raise funds from anywhere. Besides, ICOs ensure transparent use of funds, high ROI, and high reward assets that are not related to stock markets and the economy. Finally, ICO coins may be subdivided or consolidated and have the same anonymity as ordinary crypto coins.

- Cons: Unfortunately, the ICOs lack regulation and legislation, thus being quite risky. Therefore, investors are becoming more and more concerned with this problem, feeling insecure and unprotected. However, in June 2017 Yao Qian, head of Digital Currency Research Institute at PBoC, mentioned that the Central Bank of China intended to regulate the ICO market soon, as The Coin Telegraph reports. Besides, in July 2017 the Cryptocoins News website announced that Deloitte CIS and blockchain startup Waves have joined their efforts in an attempt to regulate the ICO market in Eastern Europe. According to Cryptocoins News, both companies are going to develop “legal mechanisms for regulating ICO projects in the Eastern European Region.” These mechanisms will possibly include legal services as well as ICO services and custom blockchain solutions.

- Usage Examples: The first ICO was for Mastercoin back in 2013. But the most successful and investor-friendly ICO project is Ethereum, a decentralized smart contracts platform, and programming, with ethers as coin tokens. In 2014, when Ethereum was announced, its ICO raised $18 million in bitcoins. Now ether is the world’s second popular cryptocurrency after Bitcoin. If you are eager to learn more about Ethereum cryptocurrency, check out this comprehensive guide.

#10. Peer to Peer (P2P) Transfers

With P2P transfers, customers can transfer funds from their bank account or credit card to another person’s account via the Internet or mobile phone. The market is full of P2P transfer applications, but all of them have certain limitations. For example, the ability to transfer money only within one geographical region, or, on the contrary, the inability to transfer money if both parties are located in the same country. Besides, some of the P2P services charge large commissions for their services and are not secure enough to store sensitive data. All of these issues can be solved with blockchain-based, decentralized apps for P2P transfers.

- Pros: Blockchain has no geographical limitations – it exists literally everywhere, making it possible to do P2P transfers across the world. In addition, blockchain-based transactions take place in real-time, so the recipient will not have to wait for days and weeks until they get money.

- Cons: P2P participants need to understand the cryptocurrency exchange rates and be aware that they may lose some funds when converting crypto coins to traditional (fiat) currencies. The more currencies are involved in the exchange operation, the more money you can lose. Besides, transfers of cryptocurrencies only are fast, but if the transaction involves fiat currencies in addition to bitcoin or ether, this may slow down the transaction.

- Usage Examples: Circle is a decentralized app that allows P2P transfers not only in cryptocurrencies but also in fiat currencies. As reported by Yahoo! Finance, while running on the blockchain, Circle allows its users to deposit money to Circle from a credit or debit card, not dealing with bitcoin at all. Another example of a decentralized P2P app is Bitwala, which combines the functionality of a messenger and P2P money transfer service.

These were the fintech startups using blockchain to disrupt banking. To summarize the above-mentioned blockchain use cases in banking, financial and bank blockchain technologies have the following benefits for each use case:

- Lower costs and faster processing of transactions

- No intermediaries for transactions authorization

- Decentralization and thus, independence from central repositories

- Less paperwork and bureaucracy

- Transparency

- Data integrity

- Security

However, blockchain technology in banking and finance faces the following challenges:

- Upgrade of regulations and legislation. Current regulations and legislation do not allow the use of blockchain technology finance, such as the prohibition of personal financial data immutability that we have already mentioned in this article.

- Improved security. Cryptocurrency wallets that are used for blockchain transactions should have 100% protection against hackers.

- Standards for identity verification on blockchain still need to be developed.

- More specific use cases of banks and blockchain need to be investigated.

- There should be more transparency in exchange rates between the crypto and fiat currencies.

Is blockchain the future of banking and will it replace traditional banks? Who knows – everything can happen in the nearest future. In any case, an ever-rising tidal wave of blockchain-powered technologies in finance shows that these technologies can at least disrupt the finance industry and create something totally new.

Also, find out how to implement blockchain technology in the supply chain, gaming, and healthcare industries.