FinTech is more than just a buzzword in business; It’s a mobilizer in the financial management of various industries.

Thanks to tech engineers and software developers, they’ve given rise to the emergence of financial tools and technologies. Think of these players building FinTech apps and tools used for bookkeeping, accounting, investments, and financial management, among others.

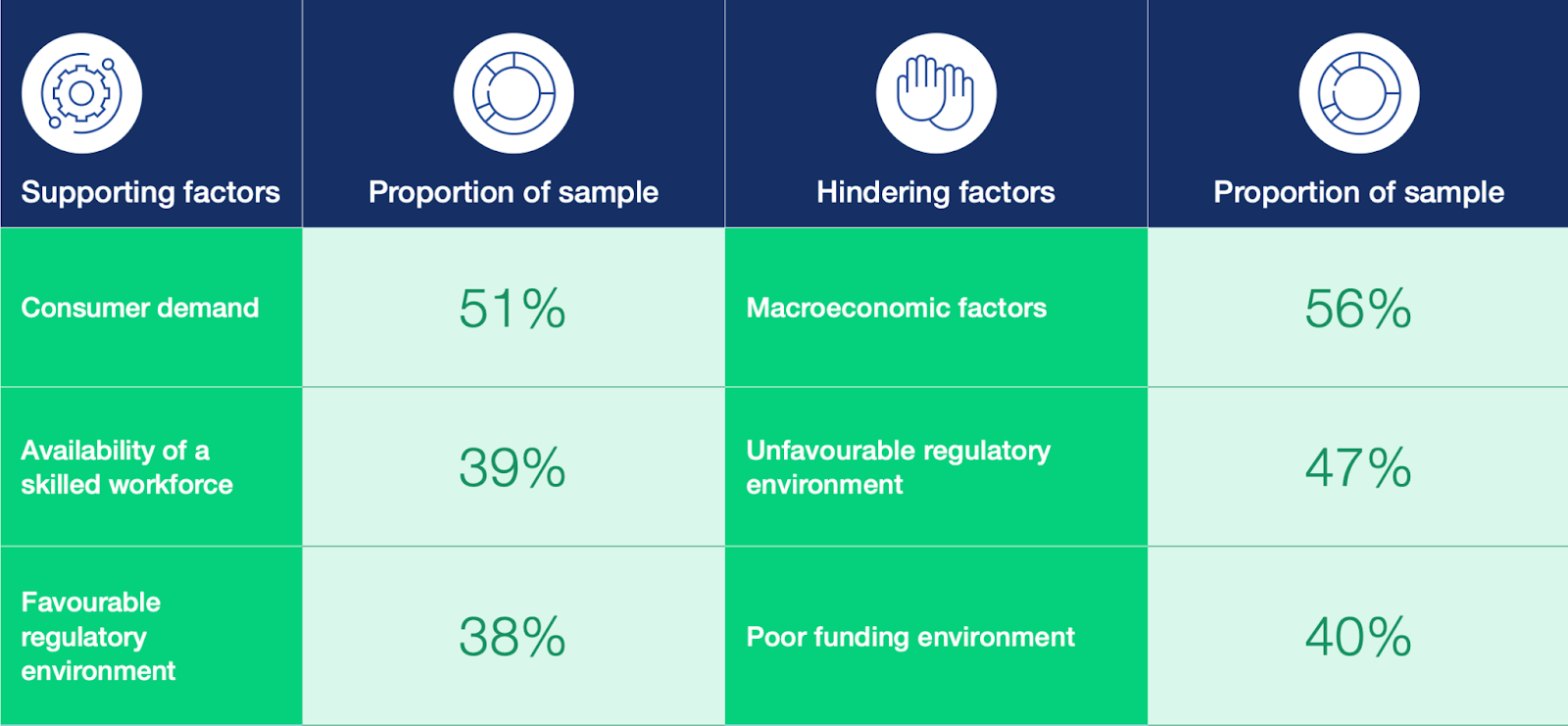

Take it from the World Economic Forum: The FinTech industry has shown resilience and growth. Such market growth is particularly due to consumer demand (51%), workforce availability (39%), and legal environment (38%). But how does it specifically affect the banking sector?

Fret not—This page covers the FinTech impact on the finance sector. Learn how it’s been disrupting the banking industry to help you make informed financial decisions. Read below.

The Impact of FinTech on the Finance Industry

First things first, what is FinTech? It’s short for financial technology, designed to improve financial products and services across different industries. It’s meant to help financial institutions, entrepreneurs, and consumers manage their finances a lot easier, faster, and better.

A trip down memory lane…FinTech began in the 21st century.

What started as promising technologies used to optimize back-office banking functions have evolved to scale different industries’ financial operations. Incredibly amazing, isn’t it?

However, it doesn’t stop there: The pandemic has triggered its inevitable digital transformation. The FinTech market has consistently grown and expanded.

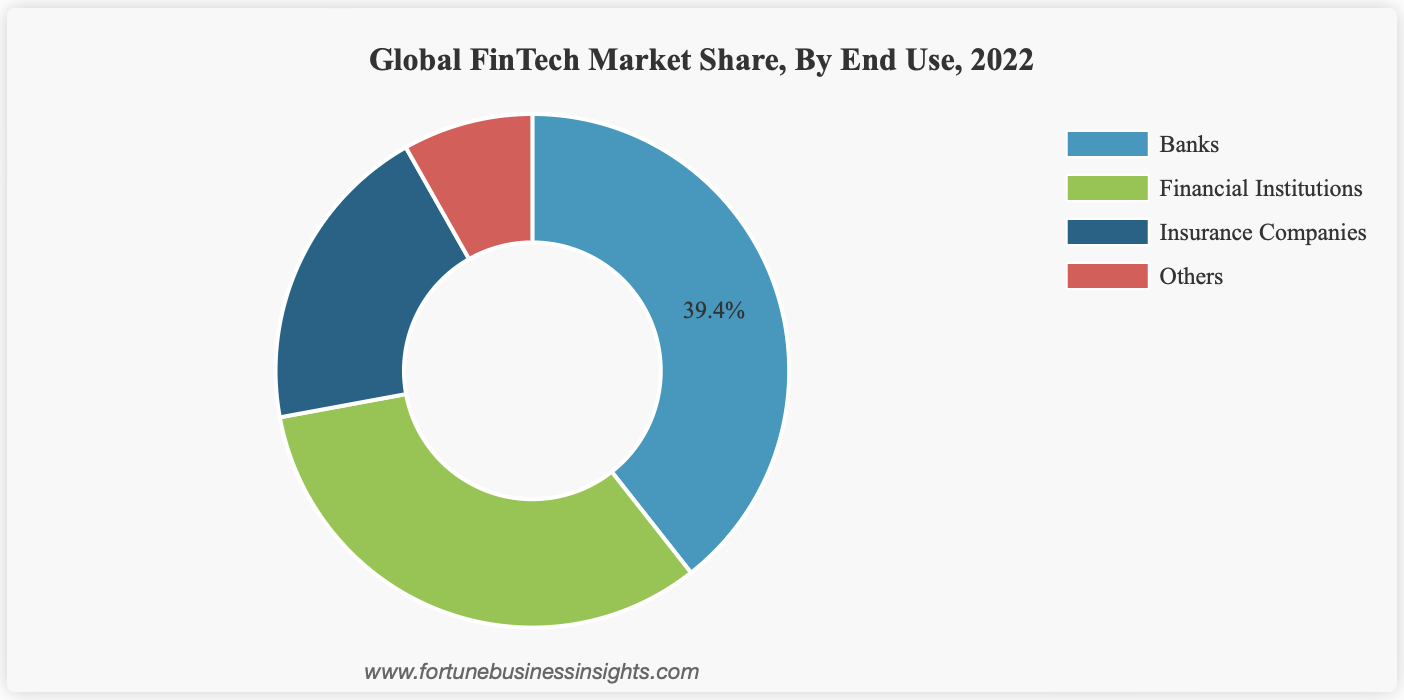

Fortune Business Insights predicts its global market to grow from $294.74 billion in 2023 to $882.30 billion by 2030 at a 17.0% compound annual growth rate (CAGR). And among all segments, the banking sector accounts for the biggest market share.

That said, here’s how FinTech proves beneficial to the banking segment:

- Accessible financial services: FinTech allows banks and financial institutions to offer online and mobile banking. It gives consumers access to financial services using internet services and mobile devices, no matter where they are.

- Increased transactional efficiency: FinTech makes use of automation to speed up financial processes and get rid of manual tasks. This technology makes financial services a lot easier and faster for the consumers.

- Enhanced customer experience: As mentioned, FinTech is instrumental to the broad accessibility and increased efficiency of financial services. These benefits translate to a boost in customer satisfaction (CSAT), making consumers fully satisfied.

- Financial data privacy and security: FinTech helps secure financial systems and protect consumer data. Think of payment gateways with encryption, authorization, and order filing requirements to safeguard customer information.

- Wealth management options: FinTech aids consumers in managing finances, whether savings or investments. WealthFront is a perfect example of an investment app that helps individuals manage their investment portfolios based on goals and risks.

- Cost reduction and business profits: Sure, investing in FinTech might be costly at first. However, it proves cost-effective for banks in the long run. Not only does it help decrease costs, but it also helps increase profits. FinTech aids in managing investments

How FinTech Disrupts the Banking Industry

Technology has drastically impacted various businesses across different industries. Think of disrupting technologies, such as:

- Automation

- Artificial intelligence (AI)

- Blockchain technology

- Internet of Things (IoT)

- Cloud computing

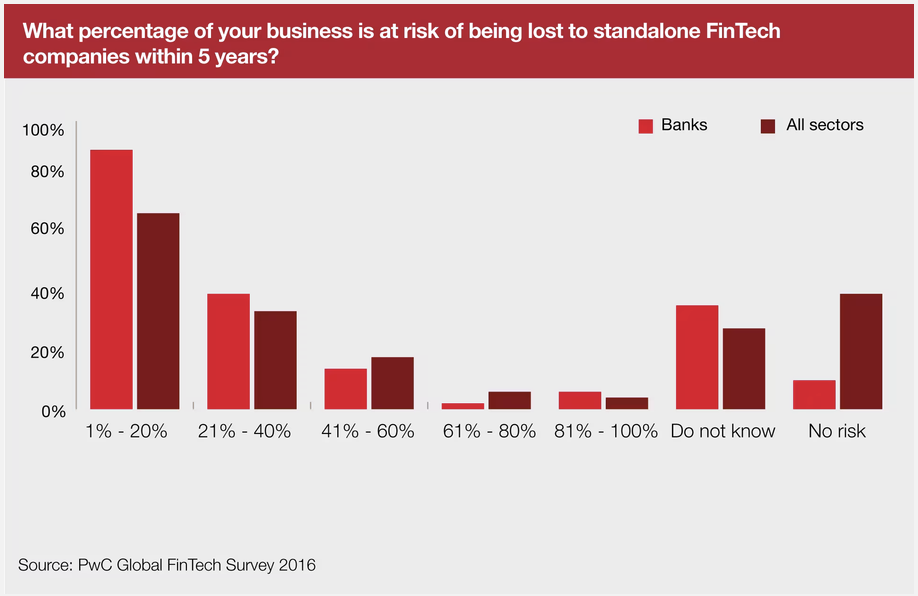

Take it from PWC: Nearly 75% of executives consider consumer banking the most likely to be disrupted by FinTech. The simplicity of banking products and services for savings, lending, and investments paves the way for such a disruption.

Key industry players see opportunities in sorting the traditional banking components and offering customized solutions to consumers and businesses. Tech engineers and software developers from FinTech companies can create more and offer something new to the table. As such, banks and financial institutions risk being lost to FinTech businesses.

That said, here’s how FinTech can potentially disrupt the banking industry:

1. It improves the entire BFSI business operations

Technology emerges not necessarily to shake different industries but primarily to scale business operations. Since its emergence in the 21st century, FinTech has streamlined various functions in the BFSI industry.

FinTech has drastically transformed the banking system and financial operations. It has improved the way banks operate and consumers transact financially.

Digital tools and technologies used by banks, financial institutions, and even insurance companies:

- InsurTech: InsurTech entails using technology to streamline insurance industry operations. Oscar Health is a perfect example of a company that offers mobile apps for online enrollment, telemedicine, and doctor search.

- Artificial Intelligence: AI involves syncing human intelligence into digital tools and technologies. Some banks employ chatbots and virtual assistants for customer service. Bank of America has its own version called Erica while Capital One makes use of Eno.

- Data analytics: Have heard of machine learning (ML) and deep learning (DL)? These AI subsets can learn from datasets and make decisions with zero-to-minimal human intervention. ML and DL power data analytics tools are used for financial analysis, forecasting, and reporting in BFSI.

2. It makes financial transactions much easier and faster

The FinTech industry offers various software solutions and mobile applications. This technology not only assists banks and financial institutions but also helps consumers manage their finances better.

Here are popular FinTech solutions used in finance and banking:

- Mobile payment apps: It’s easy to see individuals and businesses employ mobile banking. Think of online apps like PayPal, Block (Square), and Cash App, allowing people to do business and transact online.

- Digital wallets: Many businesses and organizations provide their clients or employees with digital wallets. These wallets allow individuals to receive salaries, make payments, and transact online seamlessly.

- Personal finance management tools: Software-as-a-Service (SaaS) platforms offer value-added solutions to consumers. These platforms give them 24/7 access to a wide range of financial management tools.

3. It gives stakeholders more lending or borrowing options

Banks and financial institutions have long been providing loan services to clients. However, FinTech has opened doors for various lenders, whether public, private, or peer-to-peer. They provide consumers with more lending or borrowing opportunities.

Below are some FinTech solutions offering loans:

- Online banking apps: Lending institutions are increasingly investing in online banking solutions and digital apps that allow individuals and businesses to apply for loans online. These innovations make it easier for startups and SMEs to access business loans quickly and conveniently, without needing to visit a bank.

- Peer-to-peer lending platforms: How do they work? People contribute to a particular fund via the platform. They then offer loans to other individuals—hence the namepeer-to-peer (P2P) lending.

- Alternative credit scoring: FinTech provides an alternative way of assessing individuals and determining credit scores. Banks and lending institutions now take advantage of ML or DL-powered data analytics to gain insights into individuals’ creditworthiness.

4. It opens the doorway for more diversified investments

There are various ways to raise money without a loan, such as financial investments. The FinTech industry has further offered digital tools or platforms for investing and diversifying assets. Today, consumers have several options for establishing their investment portfolio and building their wealth.

Almost every investor knows they mustn’t put all their investment eggs in one basket due to financial risks. What better way to do that than to diversify all your assets and manage your investments in one digital tool or app?

Here are some digital tools and technologies used for diversified investments:

- Investment apps: A wide range of investment apps are readily available in the market. For instance, one can use a mobile trading app to invest in stocks, bonds, REITs, and even cryptos, all in one platform.

- Robo-advisors: These artificial intelligent tools or platforms act as a financial advisor. They rely heavily on AI algorithms to provide individuals with financial advice. They can help consumers manage their investments better by minimizing costs and boosting wealth.

- Crypto exchanges: Blockchain technology is at the forefront of FinTech. Several blockchain platforms are available in the market, allowing individuals to conduct crypto exchanges. The rise of digital currencies can no longer be ignored.

5. It paves the way for the rise of digital currencies

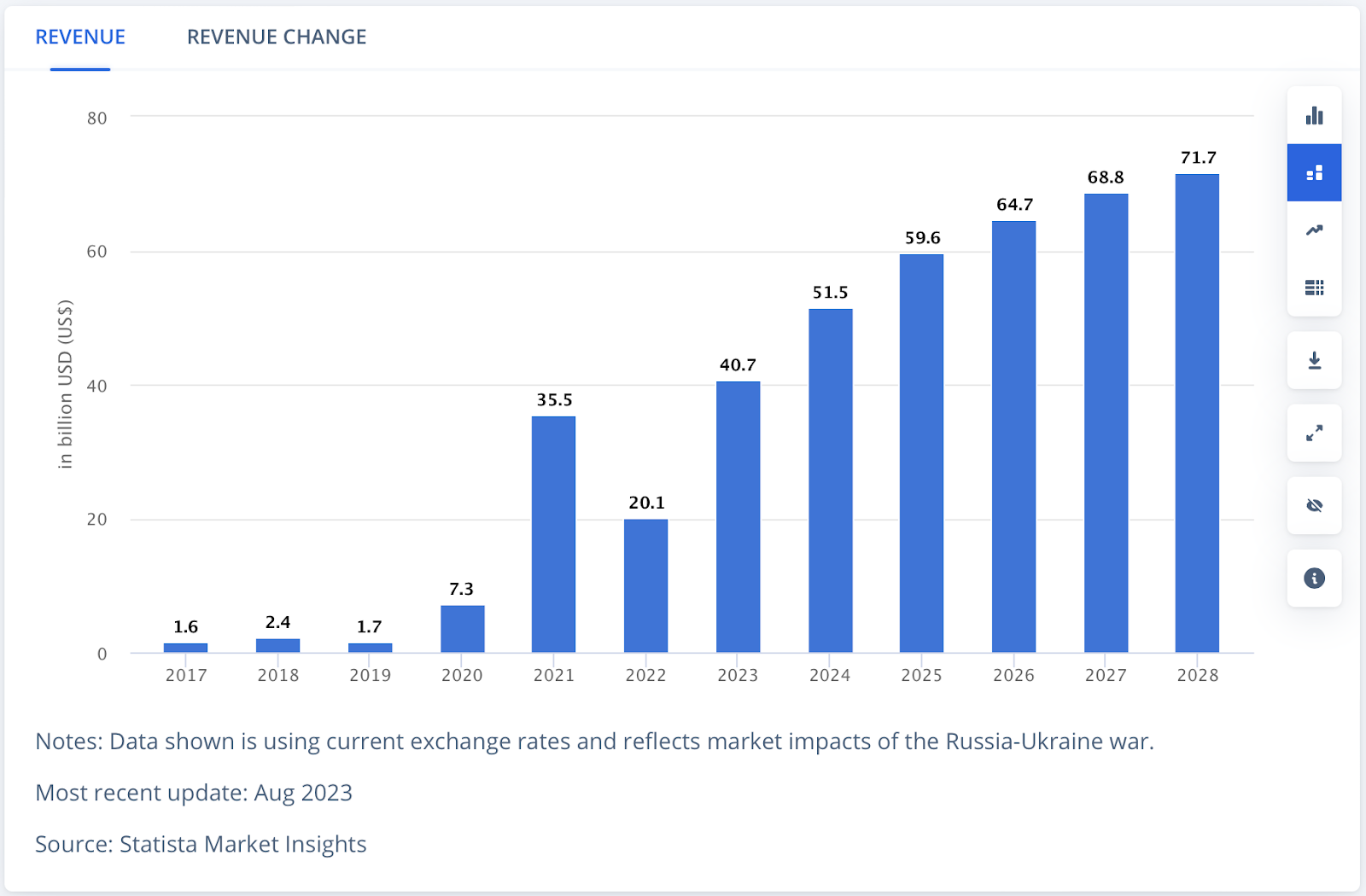

The FinTech industry has led to the sudden yet inevitable rise of cryptocurrencies. Financial institutions, digital investors, and regular consumers have begun exploring crypto transactions. Statista predicted the global cryptocurrency market will grow from $51.5 billion in 2024 to $71.7 by 2028 at an 8.62% CAGR.

As countries consider the creation of the Central Bank Digital Currencies (CBDCs), financial institutions should be open to accepting and utilizing digital currencies as early as now. Consumers should consider exploring crypto transactions, albeit with calculated risks.

Here are some of the FinTech solutions in the crypto market:

- Blockchain technology: This technology is a secured digital ledger recording financial data in blocks linked together via cryptography without a central authority. It’s known for its encryption, security, transparency, immutability, and decentralization. A perfect example is AI contract review software operating on blockchain used to draft and review legal contracts for financial entities.

- Crypto apps: These apps let people manage cryptocurrencies, such as BTC and ETC. They can store and transact their digital assets via blockchain technology. It’s safe to say that digital currencies are changing the direction and shaping the future of the banking industry.

Final Words

The message is clear: FinTech’s been disrupting the banking industry in many ways.

If anything, it has greatly improved the BFSI’s operations, making financial transactions more efficient, accurate, and seamless for the much-valued consumers. Likewise, it has offered more lending or borrowing options and investment opportunities. Finally, it has given rise to the use of cryptocurrencies.

As such, banks should consider investing in FinTech and embracing its potential disruptions for the good. Meanwhile, consumers should capitalize on the financial opportunities it brings. FinTech has so much to offer—and we’ve only just begun!